Technically oriented businessman . Over 20 years of experience in advertising and marketing technology, currently CEO and Co-Founder of INCRMNTAL.

Netflix pioneered the video subscription service. They have conquered global markets with Netflix original hits such as King's Gambit, The Squidward Game and Stranger Things .

Netflix reached 222 million paid subscriptions during the pandemic. But after its first-quarter 2022 results, the company said it had lost two-thirds of its market value due to low subscriber numbers, forcing subscription video (SVOD) players to reassess how they improve their market. evaluate

Netflix shook up the market by announcing it was launching ads to give consumers more choice and advertisers better quality than the linear TV brand. Netflix previously stated that the platform would be an ad-free site that would allow users to relax and not be exploited. So why did one of the biggest players have to add advertising to their business model and what does it mean for advertisers and ad tech?

Why is Netflix moving to advertising?

The statistics show that subscriber prospects, purchasing growth and competition are not in Netflix's favor and highlight the need for a new revenue stream. Netflix says it has room to grow, having recently hit 2.4 million subscribers. Netflix is trying to get ahead of the curve with billion-dollar productions as well as local-language-tailored content. Advertising is the next wild card.

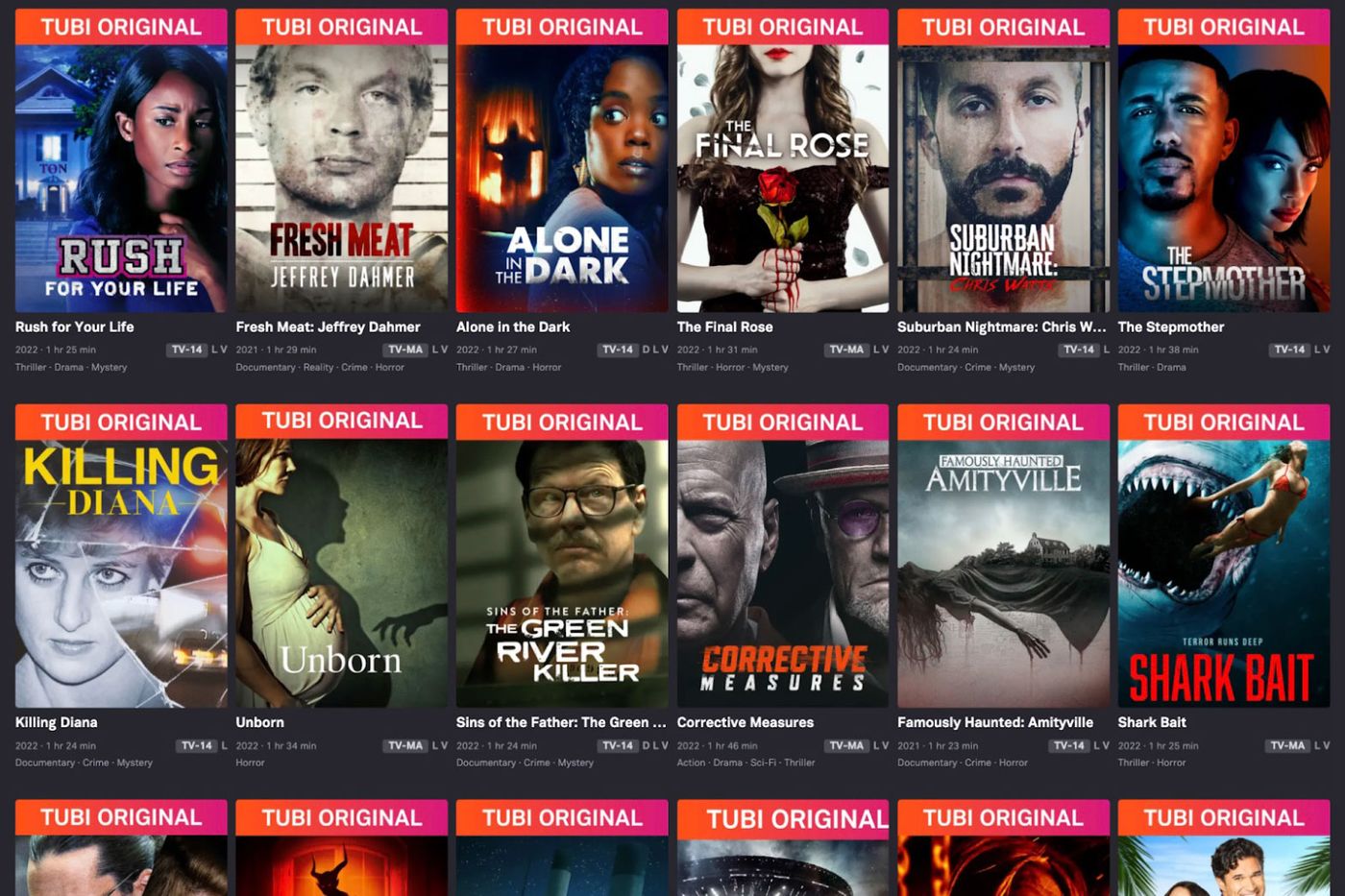

The market is seeing a growing trend towards ad-supported video on demand (AVOD) as consumers tire of expensive subscription plans and bundles. Research shows that 80% of consumers would prefer ad-supported services over more expensive ad-free services. Other video streaming services like HBO and Hulu already offer lower AVOD plans. There are also more free and ad-supported streaming services, including Amazon Freevee, Tubi, and the Roku Channel.

Netflix set the stage for CTV's leadership and set high prices to attract the most premium brands, meaning first. The advertiser pool will likely consist of Fortune 500 companies that can afford to pay $20 million.

While skeptics abound, major brands such as L'Oréal, Nyx and Anheuser-Busch InBev have already publicly signed on. Novelty and premium pricing strategies may attract these players, but Netflix will allow advertisers to directly buy ad space for each program in the long term through a partnership between Netflix and Microsoft Ads.

What does this mean for advertisers?

Advertisers want to ensure the effectiveness of their ads. Inspired by other self-reporting platforms, Netflix won't let marketers track you directly. No one knows if Netflix's ad returns will be positive. Netflix has not shared detailed data about its audience composition or allowed advertisers to target demographics. Instead, they used a semantic approach to audience measurement to show marketers that Netflix ads were driving growth. But is it so?

While these partnerships aim to make advertisers' lives easier, it's unclear whether advertisers will benefit more from this new revenue stream for Netflix. A key factor has to do with projected audience size, with reports ranging from 500,000 to 40 million people. That's a pretty significant difference.

As with any multi-channel marketing strategy, it's important for brands to understand the impact and added value of opening a new channel to their existing campaigns. Advertisers should consult the OTT guidelines to help align campaigns with their strategy. They also need to understand what targeting options are available and what new audiences can be reached. Because this level of AVOD subscription is aimed at price-conscious viewers, it's important to send the right messages. This does not mean that messaging and quality should be reduced. Netflix will continue to produce high-quality content, and advertising should reflect that.

Understanding the impact of Netflix campaigns on paid search campaigns will allow advertisers to measure audience overlap between their channels, prioritizing those with the highest impact in terms of value. Marketers and marketing analysts must work closely with brand managers or category leaders to monitor performance gains from this new channel. When planning and budgeting, it's important to ask yourself the right questions.

1. What is channel cost?

2. Which channels are actually being "lost" because of Netflix ads?

3. How will this affect my multi-channel marketing strategy?

Additionally, brands should consider whether these high CPMs can be justified using traditional user-level tracking and metrics. While this can be a great choice for all stakeholders, the metrics need to be as perfect as the targeting. Marketers should work closely with their analytics teams to measure the impact of Netflix ads on their overall marketing performance.

Advertisers should also be aware of the challenges they face when evaluating offline marketing campaigns. The lack of direct attribution is a hindrance, as many marketers in today's world rely on user-level tracking as a proxy for marketing metrics. Since this is not possible for Netflix ads, advertisers may find it useful to discuss what the ideal proxy metric might be for their business needs.

Final thoughts

As Netflix ads change the CTV landscape, the move is likely to eclipse all other platforms and absorb most of the cost growth. But where will the demand come from? Will advertisers shift budgets from other video channels to Netflix, or will Netflix ads take CTV's world to unimaginable heights? It's likely that once the novelty wears off, advertisers will turn to Netflix, demanding not only more sophisticated targeting, but steps to prove that the big investment was worth it.

As advertisers take advantage of this new opportunity, it's important to understand the impact of launching a new channel on their current campaigns, assess their cross-channel audience status, and budget appropriately before making the decision to switch.

The Forbes Technology Council is an invitation-only event for CIOs, CTOs and CEOs of global technology companies. Am I right?